| CATEGORII DOCUMENTE |

| Comunicare | Marketing | Protectia muncii | Resurse umane |

A C A D E M I A D E S T U D I I E C O N O M I C E

F A C U L TA T E A D E M A N A GE M E N T

BUSINESS PLAN

D&I

Executive Summary

Our company,D&I is a specialty chemical formulator, lab analysis agency, and toll manufacturer, selling products to companies from cosmetics manufacturers to food supplement marketers. We manufacture and distribute Creatine Monohydrate, an approved food supplement used to improve strength, endurance, and muscle mass. D&I also produces five other speciality chemicals that will be detailed later in this document. A strong knowledge-based management team, with a combined five years of experience in this industry, incorporated D&I in 2002.

D&I is a niche player in the speciality- and

industrial-chemicals business, focusing on value-added products which are not

widely or readily available in the

Our distributors and our customers have given us an opportunity to provide products beyond our present capability. We need to add equipment, increase our inventory, and establish marketing and support activities.

Sales and Projections

We have had sales of, $241,782 in 2002 and $269,507 in 2003. These numbers give us a strong reference point on which we have based our sales projection for the upcoming three fiscal years. Our projected sales for 2002 are $210,000; we project this to increase to sales of over $2.2 million in 2003, and to over $2.6 million in 2004 (see table in the Sales Forecast section).

Funding Requirements

We are seeking adequate capital to enable us to expand our operation and become a major factor in the production of chemicals in the industrial, consumer, and textile markets Our signature product is Creatine Monohydrate; we manufacture both the powdered and liquid forms. We are the only company in the world capable of manufacturing this product in liquid form. Our market research shows that the demand for this product alone justifies the expansion of our facilities.

Objectives

The objectives of this business plan are outlined below:

Sales exceeding $2.2 million by 2003.

Gross Margin of 50% or more.

Net profits of over 16% of sales.

We have the management team and the chemical formulations to become a major player in the specialized niche we serve. We have developed new technology and processes that are in demand by other chemical manufacturers as well as by major distributors who do not have the ability to produce our speciality products. We see our mission as not only that of toll and custom manufacturer, but as a trade supplier where we can reach the end-user market with products we consider to be proprietary. We seek a fair and responsible profit, enough to keep the company financially healthy for the long term and to satisfactorily compensate owners and investors for their money and risk.

Products

Creatine Monohydrate This is a dietary supplement commonly used by atheletes to

improve strength, endurance, and muscle mass. Creatine has become the most popular body building supplement in

use today. It is sold in many forms through health food stores, drug stores,

and discount chains. The leading producers of Creatine are in Europe, and only a few recently in the

Kelate Cu This is a specialty product used in cosmetics. It is distributed through Tri-K Industries by special arrangement. Their largest customers are Estee Lauder and Revlon. We project sales of this product to be between $140,000 and $175,000 per year.

Melasyn 100. This is a synthetic form of natural melanin. It is used as a pigment for vitiligo preparation and as a self tanning agent. It is water soluable, which makes it easy to formulate in cosmetic preparations. We are working with Larchmont Technologies to supply this product to Tri-K. We project sales of $250,000 in 2003.

G-REZ DB. This is a specialty coating material used on industrial buffing pads. We developed the product at the request of the Jackson-Lea Corporation and sales can reach $300,000 in 2003.

Becrosan 2128A. This

is a corrosion inhibitor with a bright future. Similiar chemistry has been very

successful in

Ion Exchange Resins We provide a toll drying service for Purolite at a level of $35,000 per year. We feel this can increase substantially with additional equipment.

Recrystallized MAGH This is a crude licorice extract. We purify the extract into an edible grade flavoring using our proprietary recrystallization process. It is then used in both food and tobacco industries. We teamed with MAFCO, the world's largest distributor of licorice, to develop the process. Richman Chemical is the broker. Estimated sales based on current demand levels are $75,000 in 2003.

Market Analysis Summary

We are a highly technical niche player with a specialized product line that is in great demand. Our target markets are the distributors who have established relationships with speciality products firms, textile chemical companies, and consumer products outlets. We are essentially the manufacturing arm for these distributors and can provide development services, as well as products for them.

Market Segmentation

Our market is divided into three segments:

Industrial Products: In this segment our customers include Lubrizol, Purolite and Tri-K Industries.

Consumer Products: Handled primarily through distributors.

Textile Products: Customers are: Seydel Corporation, Jackson-Lea, Delta Mills and Tex-Mex distributor.

Customer Profiles

Seydel International and Seydel Wooley. These companies are manufacturers and distributors of textile speciality chemicals. Our sales to them in 2003 were $59,000, and were $72,000 in 2002. Our sales to them are estimated to grow to $250,000.

Larchmont Technologies. A marketing and chemical broker company. We provide product and process development and manufacturing services. They are the agent for Creatine Monohydrate, Kelate CU, and Melasyn 100. The potential here is over $2 million in sales.

Richman Chemical. A marketing company and chemical broker. We process ion exchange resins and purified MAGH for them. We can anticipate $200 to $300,000 in sales to them per year. Their own sales exceed $20 million per year.

TRI-K Industries. A marketing company with over $60 million in sales. They specialize in cosmetic and personal care products. They are the distributors of Kelate Cu, Melasyn 100, and Provitamin B-5, all of which we produce for them.

Gateway Additive. This is a $30 million subsidiary of Lubrizol, Inc. We produce corrosion inhibitors for them.

Jackson Lea Corporation. The world's largest supplier of industrial buffing pads. We have developed special coatings for them which have been approved and recommended to their worldwide subsidiaries.

Purolite Corporation. Manufacturers and distributors of ion exchange resins. We provide both custom and toll manufacturing processes for them. Custom and toll manufacturers are two types of distributors that D&I serves. A custom manufacturer may provide the materials for D&I to use the formula and processes on. A toll manufacturer provides their own materials and formulation for D&I to mix the product.

Target Market Segment Strategy

Consumer Market: This is potentially our biggest market for Creatine Monohydrate; it is limited only by our ability to produce. We have distributors who are begging for the product and we have back orders now, so it is only logical that we will devote most of our time meeting this demand. We look at the potential in this market as the basis for our growth.

Industrial Products: Here, we are selling both through distributors as well as direct to manufacturers. This is an untapped market and has been sustained by our reputation and ability to meet formulation criteria. We know that a marketing effort in this segment will produce sales that could quite possibly bring this segment to an equal level with the consumer market.

Textile Products: We have enough experience within this segment to know that once our

manufacturing capability is up and running we could actually devote an entire

marketing effort to this segment alone. Both our toll and custom manufacturing

capability is strategically attractive to all textile manufacturers, including

growing markets outside the

Industry Analysis

The chemical industry is characterized by a wide variety of companies ranging in size from the large companies such as DuPont and Monsanto to smaller specialty firms such as ours. The companies are generally organized by either end-use markets or product technology. In the past decade there has been a general trend in the industry to change emphasis from chemicals to biotechnology and pharmaceuticals. The cost of product development and the need to operate factories at high levels of capacity have caused chemical companies of every size to outsource parts of the chemical and manufacturing processes. This has created opportunities for smaller companies to create and occupy niches in development and contract manufacturing. The outsource industry providers occupy a market segment commonly identified as custom and toll manufacturers.

Competition and Buying Patterns

In the mainstream business, channels are critical to volume. Manufacturers and distributors with impact in the international chemical market desperately need speciality and toll manufacturers like us to meet the demand. There are many specialty manufacturers, all of whom seem to have carved out a specific niche of expertise, and upon whom these major manufacturers depend for products. In competition, it seems that the line is drawn at the level of quality performance. We have achieved that level and are recognized for a high standard of quality performance. Companies who would seem to be our competition have subcontracted production to us because they do not have the ability to supply that level of quality.

We have achieved another milestone in the industry by developing certain formulations which we estimate would cost another firm $450,000 to duplicate. The Creatine Monohydrate formulation and process is one of them. We have the only process in the world that can produce this supplement in liquid form. It is extremely important that we seize this opportunity and begin to exclusively market this product.

Strategy and Implementation Summary

We address the market through three business segments: speciality products, textile chemicals, and consumer products. We are a highly technical niche player who has developed strong alliances with distributors who have powerful channel relationships but lack manufacturing or product development capabilities.

Our marketing strategy assumes that we will serve these distributors in three ways:

Toll Manufacturers, where our customer provides the raw materials and the formulation and we mix to his/her specifications.

Custom Manufacturers, where our customer may provide materials but we provide the formulation and the processes.

Trade Supplier, where we develop and sell our own lines of products based on industry and customer needs.

Competitive Edge

Our competitive edge is in the formulations and manufacturing processes we have developed for the production of the seven products in which we specialize. As detailed above, we are in an excellent position to capture a significant part of the $300 million Creatine Monohydrate market. We simply need to establish a marketing program and begin to promote our capability.

Sales Strategy

Our sales strategy is outlined below in three phases.

Phase One is to accommodate our existing customers and to make sure that current orders and subsequent orders are maintained.

Phase Two will commence when our facilities are expanded. We will then be able to accept new clients and contact companies who have shown interest in our products and be able to accommodate their orders.We plan to hire a high-quality sales person to assist in defining our marketing program.

Both phase one and two will primarily be toll and custom manufacturing.

Phase Three will begin with the hiring of two additional sales representatives who will develop our end-user program wherein we will begin to sell our own product lines.

Management Summary

We have a strong management team that can boast of over 30 years experience in technical and management expertise. Each member has a specific contribution. The president and CEO has spent 20 years working in the chemical industry, and is adept at expanding companies that are well-grounded, but lacking in funding. The vice president of D&I is a specialist in consulting for small business on strategic planning and growth programs. And the final member of the team contributes expertise in start-ups among the pharmaceutical industry. Together, this team has a proven background of expertise and is more than capable of transforming D&I into a leading specialty chemical manufacturer.

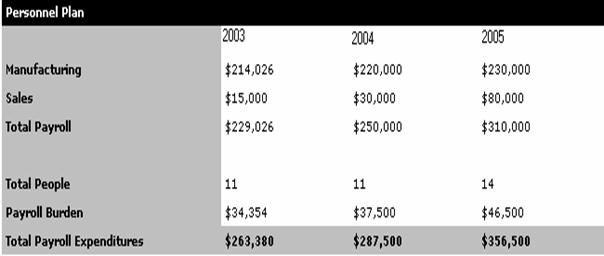

Personnel Plan

Our present plan is to immediately bring two people into the manufacturing operation, followed by an additional two or three throughout the next year. We need to begin looking for a capable marketing professional who has a background in chemical sales. We would like to bring that person on board mid 2003. Followed by one or two sales representatives with both interpersonal and telephone marketing skills. We will also employ support personnel as required.

Per

Financial Plan

We plan to support our growth and debt obligations through increased sales and cash flow. Our major debt with Wachovia Bank is $324,550, which is secured by $508,000 in personal and company collateral. Our financials do not include our estimate of $450,000 in proprietary chemical formulations, and a $350,000 value of assignable customer contracts.

Projected Profit and Loss

Our profit projection for 2003 is an attainable $402,637, which is before taxes or debt service. In 2002, we anticipate an increase in net profit to $700,719, which is 26% of sales, and in 2003 we project $1,342,549 in profits, which represents 38.9% of sales

Projected Balance Sheet

Our projected balance sheet shows an increase in net worth to more than $3.5 million in 2003, at which point we expect to be making profit of over $1.3 million. Our financial projections show a significant part of our net worth to be from paid in capital and a positive figure in retained earnings. We are increasing assets in order to meet our equipment and facility requirements, and because we need to increase our receivables and inventory to support our growth in sales. Monthly projections are in the appendices.

BIBLIOGRAFIE:

BROSURI TIB - ROMEXPO

".BUSINESS WEEK" - NO. 1/2002

WWW.CHIMICS.COM

WWW.GENERAL.COM

WWW.U.S.INVESTEMENT.COM

|

Politica de confidentialitate | Termeni si conditii de utilizare |

Vizualizari: 1917

Importanta: ![]()

Termeni si conditii de utilizare | Contact

© SCRIGROUP 2026 . All rights reserved